santa clara county property tax credit card fee

A non-refundable processing fee of 110 is required in Santa. The fee amount is based upon a.

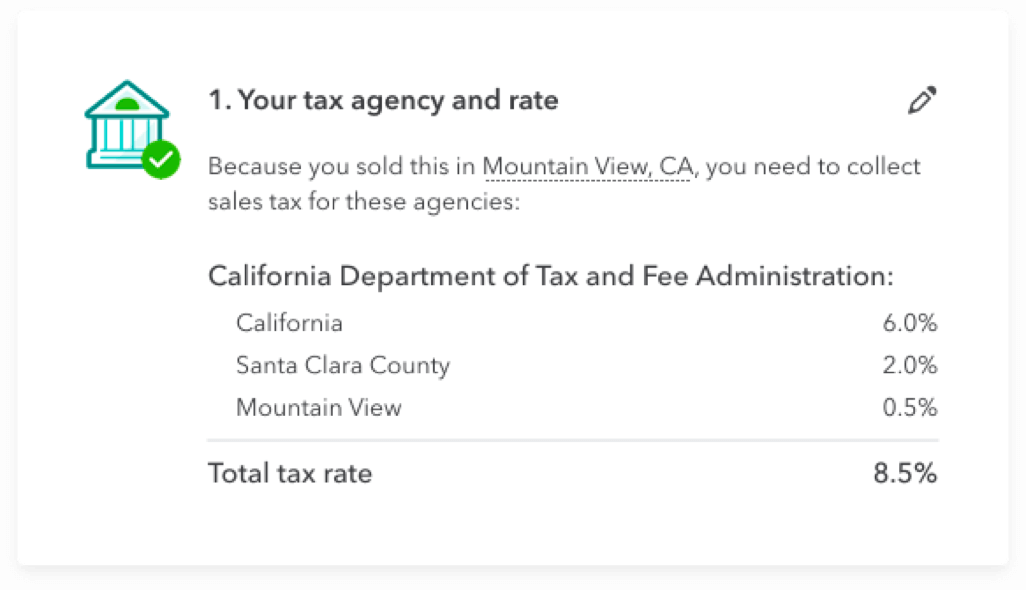

Property Taxes Department Of Tax And Collections County Of Santa Clara

Sunday September 4 2022Edit.

. The office is located at. The Clark County Assessors Office provides property. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

Electronic Check eCheck No Fee. There is no fee for internet payments in Santa Cruz County. The county does provide a web portal to pay your tax bills.

Failure to pay the balance by the due date will result in a 10 late fee plus a. Valuation Based Fee Table for Building Permit Review. We accept payments of cash checks and credit cards Subject to transaction fee see below.

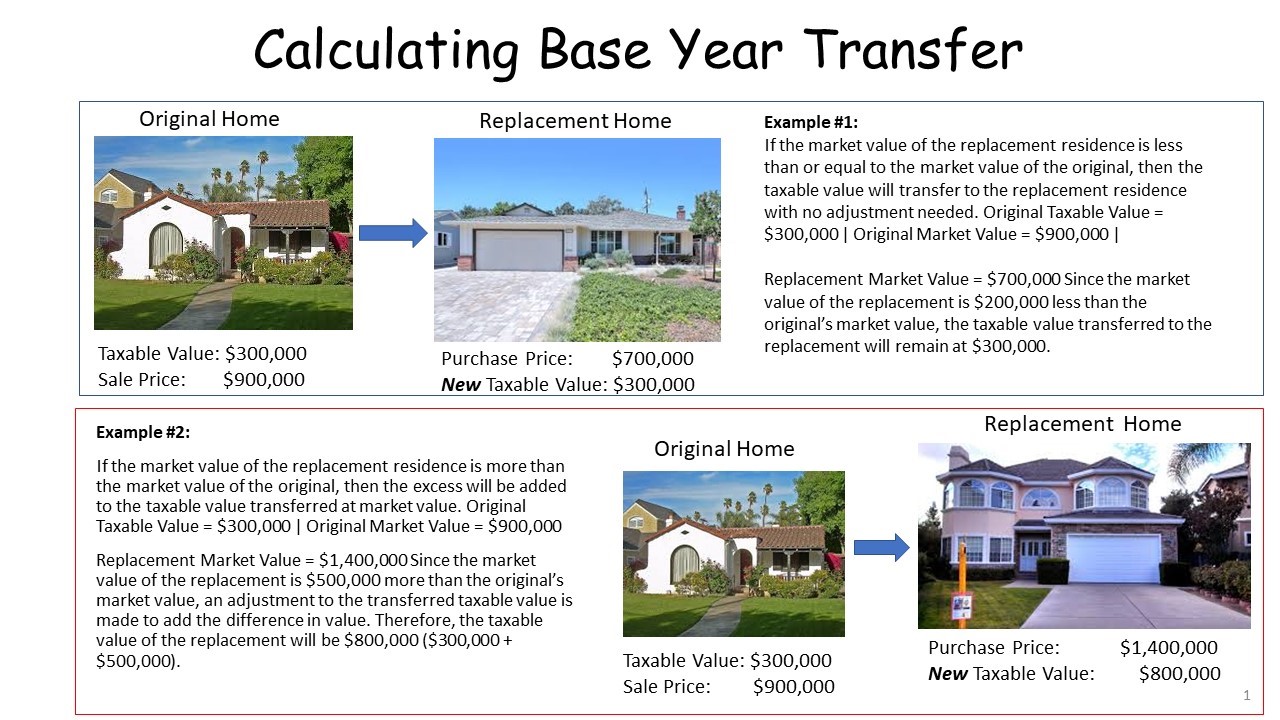

The bills will be available online to be viewedpaid on the same day. If You Use A Credit Card In Santa Clara County Can You Pay Property Tax. Property Tax Fee Amount.

Grand Central Pkwy 4th Floor Las Vegas NV 89155. Santa Clara County CA Property Tax Calculator - SmartAsset. Santa Clara County 1800.

The Santa Clara County Tax Collector. Business Tax Fee Amount. 77 - Dattathreya Temple 94 -.

Additionally the county of. 0720 of Assessed Home Value. Property owners in Santa Clara County have until 5 pm.

You may pay your property taxes by electronic check mastercardvisa debit card or by mastercard visa discover or american express credit card. Look Up Property Records. 0740 of Assessed Home Value.

Search Santa Clara County Records Online - Results In Minutes. Skamania County has partnered with. Click here to access online payment page.

Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to. Credit Card American Express Discover MasterCard Visa 225 with 200 minimum. 730 AM - 430 PM.

Santa clara county property tax credit card fee. The fee to use a credit card will vary based on your county but theyre almost always at least 2 and often more than 25 of the total tax amount. Ad Start Your Santa Clara County Property Research Here.

Confidential Marriage License 8300 Pay with cash check or creditdebit card 250 convenience fee for credit and debit cards Get Married. On Monday April 11 2022 to pay their taxes. You will be charged a convenience fee along with the property tax amount when you pay your internet bill.

Credit Cards - Master Card Visa Discover American Express.

Joshua Basin Water District Civicmic Outreach And Public Engagement

Santa Clara County All Archives Valley Of Heart S Delight Blog

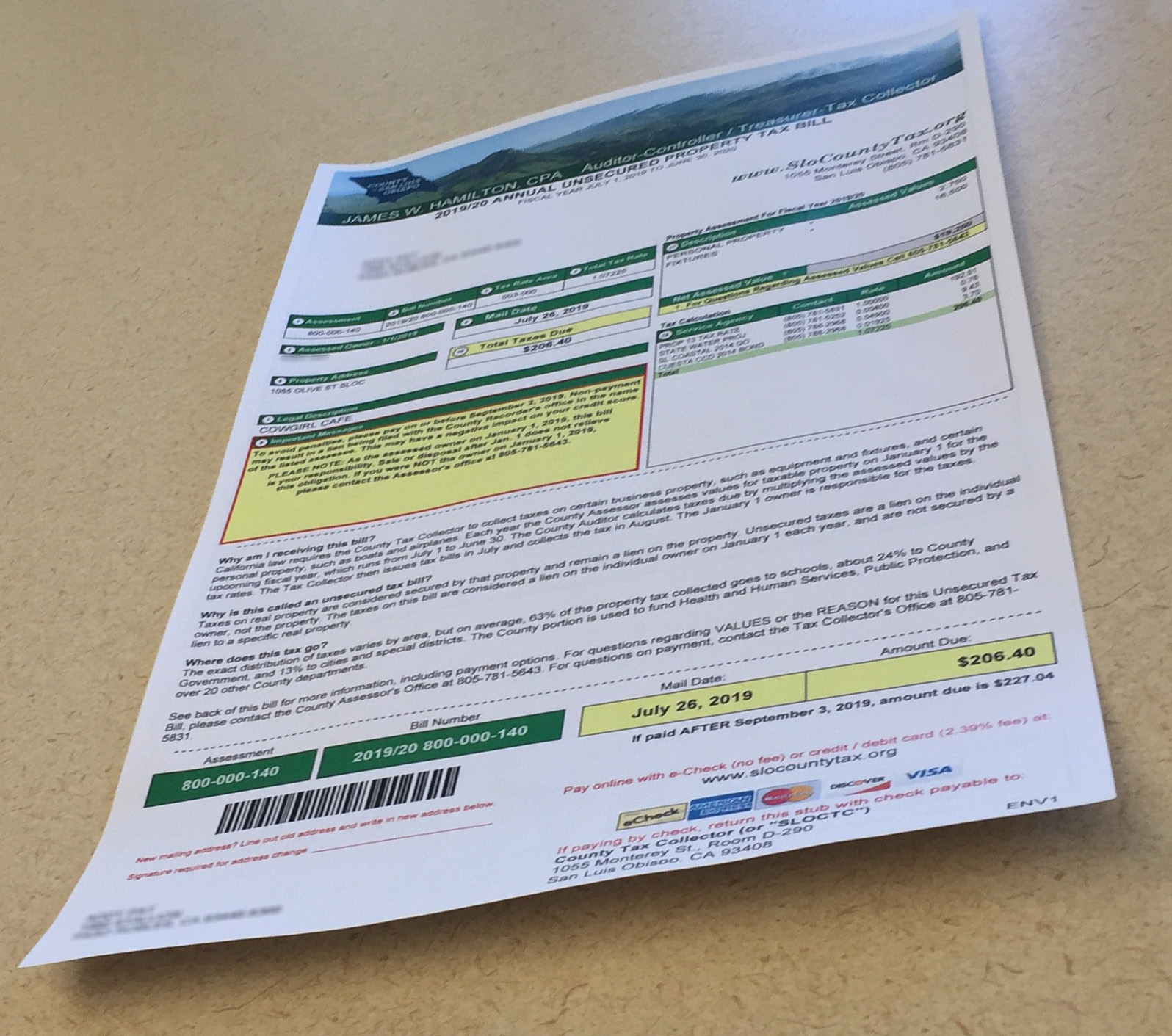

Tax Collector County Of San Luis Obispo

Property Taxes Lookup Alameda County S Official Website

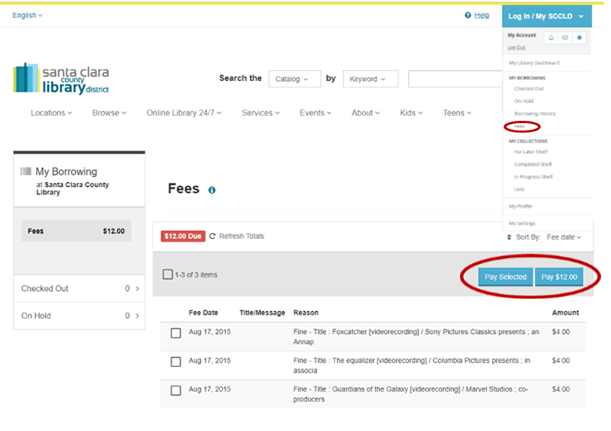

Pay Fees Or Donate Santa Clara County Library District

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Mobile App Department Of Tax And Collections County Of Santa Clara

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Payment Information For Santa Clara County Property Tax Due Dates

California Gas Rebate Another Plan But Little Action Calmatters

Classes Activities City Of Santa Clara

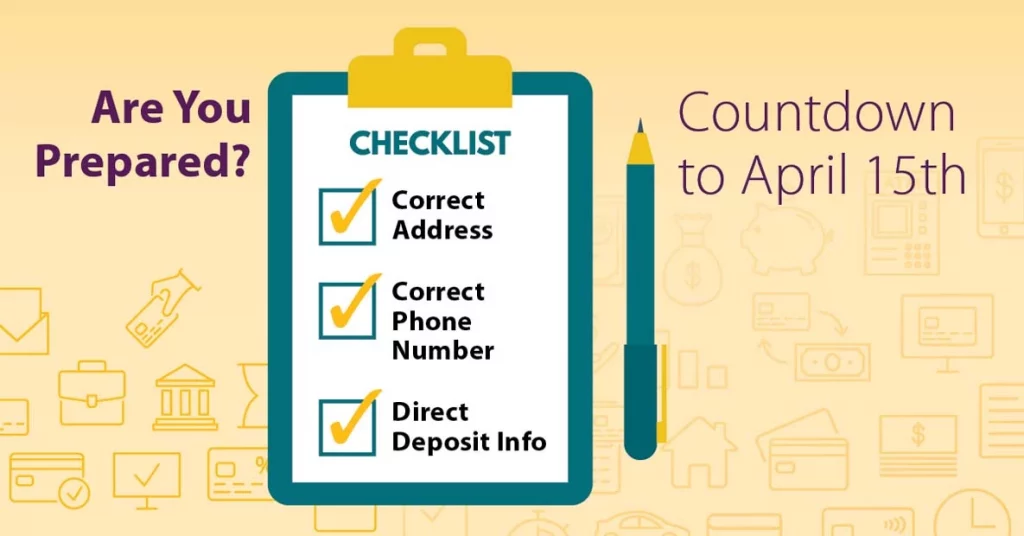

Are You Ready For Tax Season Santa Clara County Federal Credit Union

Santa Clara County Federal Credit Union

Manage Sales Taxes Mileage And Receipts Quickbooks Online Advanced

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

Credit Card Debit Card Service Fees Oc Treasurer Tax Collector

Job Opportunities Superior Court Of Ca County Of Santa Clara